Solar Incentives

– 30% of total installed cost = Federal Tax Credit

– Any electrical upgrades that are “necessary for solar” – get same 30% Tax Credit

– Utilities statewide will *currently* reimburse up to 50% of cost- that offer will reduce slightly in the future (June ’18)

– Property Tax Assessment-exempt

– Free power guaranteed. AKA Net Metering.

– Homegrown “Zero Down Solar” Lenders. As low as 3.5%

Facts

– The WSU Energy Program in Olympia WA monitors State Incentives

– The sooner you go solar, the better!

– The term “Solar” refers to Solar Photovoltaic electrical generating systems.

– Photo = Light :: Voltaic = Electricity

– State Incentive program offer dips slightly each June 30th

– State Incentive program closes June 2021

– 25 year warranty for panels. 40 years of respectable energy production.

– Summertime production is better in Seattle than any other city in the Lower 48

– Excellent resale value, esp. in coastal counties.

– Warranties, ownership, incentives – all easily transferrable

Features

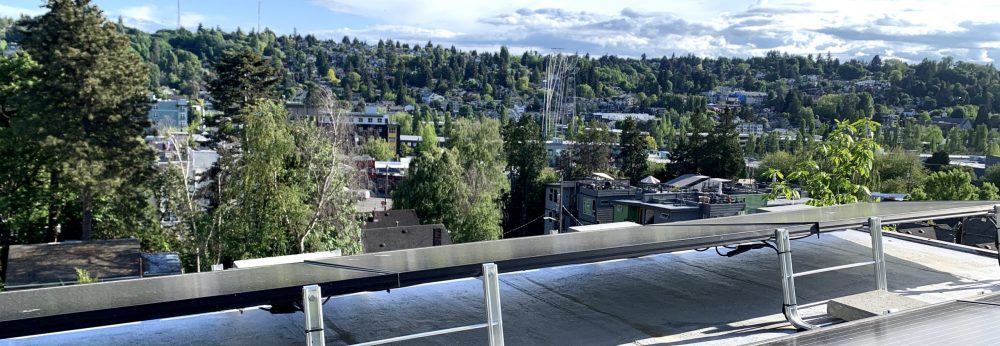

– Various aesthetic choices available. Not all installs have to look the same.

– Panels are lightweight > 40lbs./ea.

– Hail-proof, non-reflective glass is standard

– Per panel monitoring feature is typical. Internet log-in and cloud based features.

– Systems are owned by the real estate property owner. No Leasing in Washington State.

Specifics

– HOA restrictions in WA are slight. Case by case basis, often favors solar with black frames.

– Roof mounting is typical, ground mounts are more common in rural areas.

– Verity CU and PSCCU offer solar-specific loans with flexible/favorable terms.

**Local Solar Industry groups such as Solar WA & Solar Installers of WA peer-approve their new members. Choose an installer from their membership!**