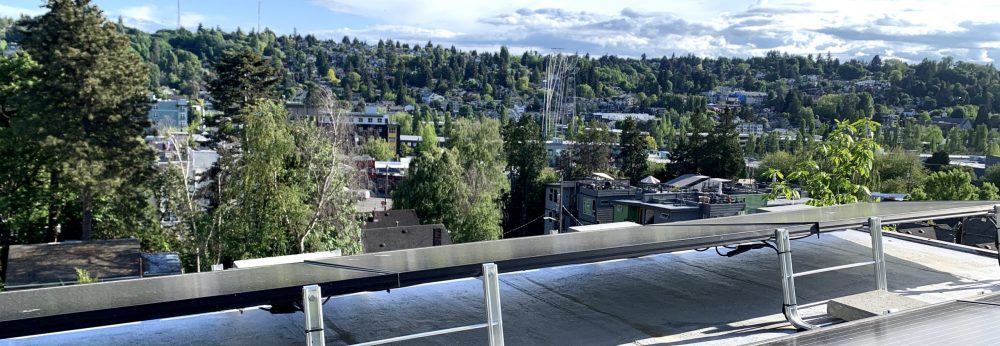

Add this home improvement and in the long run, save money and add value.

- Free electricity from the solar install!

- No WA State Sales Tax

- Exempt from Property Tax Assessment

- A 26% Federal Solar Investment Tax Credit (must be installed before Dec. 31, 2022)

Applicable Solar Incentives:

26% of the total solar invoice is equal to the Tax Credit. For example, a $20,000 solar install would be a $4400 Tax Credit.

Your Residential Rental property is classified as a Business, or income-generating. The 26% becomes a Line Item Credit on your tax liability. This is the same percentage amount as the Solar Tax Credit that residential homeowners enjoy. The IRS wants you to file the Tax Credit differently but the total credit percentage is the same.

Additional Cost Recovery:

If your rental property is a qualified business then it’s likely you can depreciate, or “write off” your investment in Solar. There are limits on how much credit can be taken in a year. I can provide all of paperwork needed to pursue this. Let’s be sure and consult with your accountant first, for instruction and advice regarding this possibility. See #1 below, IRC Section 48 – Energy Credit, MACRS and Accelerated Depreciation Schedule.

References: